All about Credit Union Near Me

"We take a look at cost structure and places to make sure [they] benefit the greater excellent," he says. When you sign up with a credit union, you become an owner, and that status translates into specific privileges: Credit unions use some of the best rates on credit items such as vehicle loans, home mortgages and credit cards.

Not known Details About Credit Union Near Me

That can be a huge relief when your funds dip into the single digits. If you do not have a credit report or do but it's harmed, you could have major problem scoring a credit card or loan with a low rate from a bank. Credit unions are more forgiving of individuals in this position.

Credit unions tend to provide greater interest rates on cost savings and deposit accounts than banks do. Massachusetts-based Digital Credit Union, for instance, currently provides members an excellent annual yield of 6.

The 45-Second Trick For Credit Union Near Me

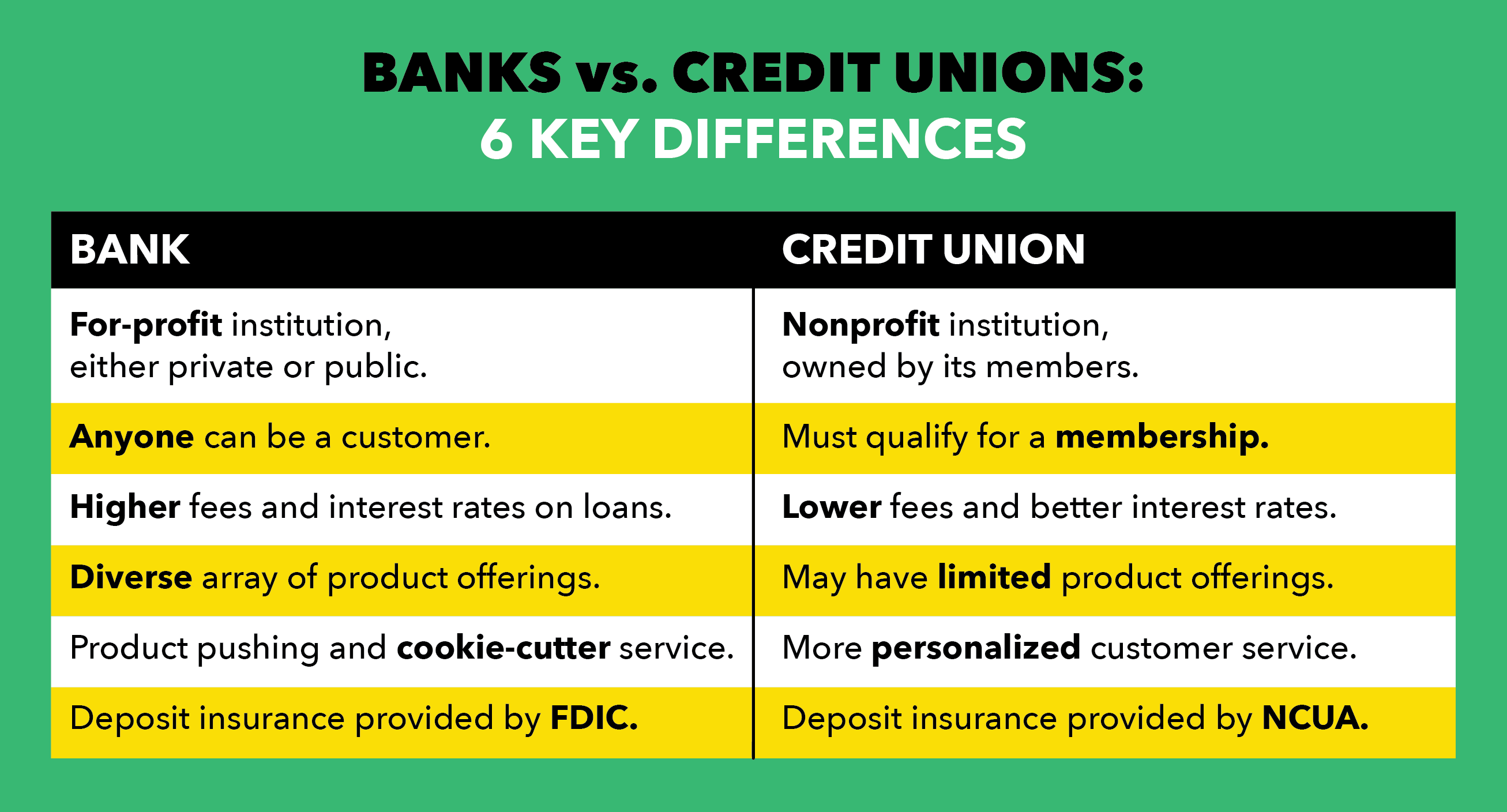

Desire to have all of your accounts in one place, consisting of charge card? The majority of cooperative credit union provide them, but there may not be a variety of credit cards from which to choose. Those with huge sign-up rewards and other specialized rewards programs probably won't belong to the lineup. credit union near me. Cooperative credit union typically accommodate a specific neighborhood or occupation.

The Of Credit Union Near Me

To end up being a member of State Employees' Cooperative Credit Union, you'll need to be a worker of the state of North Carolina. Still, credit unions may deserve thinking about if you're unhappy with your bank or are searching for a more community-focused environment. If you think a cooperative credit union might be an excellent choice for you, however you're unsure if you're qualified for any in your community, do not quit.

"Individuals automatically believe they can't join due to the fact that of the name or worry that it's some sort of club. That's not true at all. You can discover a credit union that's right for you. Have a look at what remains in your location, then stroll in the door and talk with someone." If you do, possibilities are a friendly agent will invite youand might draw you in as a new member of the family.

Not known Facts About Credit Union Near Me

Today's clients are looking for more than just an organization to assist them manage their money. They desire to find a location that not just takes care of its members, offering excellent rates and competitive services, but likewise contributes to the wellness of their neighborhoods, rather than that of their stockholders.

Not known Facts About Credit Union Near Me

How does the non-profit and member-owned characteristics of a credit union particularly help its members? By focusing instead on members and handing down the benefits to them, credit unions can use the following advantages. A cooperative credit union's concentrate on its members, not its revenues (and the accompanying nonprofit, tax-exempt status), suggests that rather of making money off of customers, excess earnings and cost savings are passed onto consumers.

Credit Union Near Me - Questions

Instead, one major benefit of nonprofits is that members can get much better interest rates:. From home mortgages to automobile loans, cooperative credit try this website union are often able to use the most affordable interest rates on loans. If you're searching for a place to grow your cost savings, the rate of interest on cost savings accounts, cash market accounts, along with certificates can be much higher than those used at banks.

At Palisades, this consists of: Credit unions can decrease the barriers to getting a home loan for their clients. Even if your credit is less-than-perfect, a credit union might be able to assist you protect a home loan when banks turn you away.

Comments on “Everything about Credit Union Near Me”